HOCHTIEF as an investment

Our six reasons

-

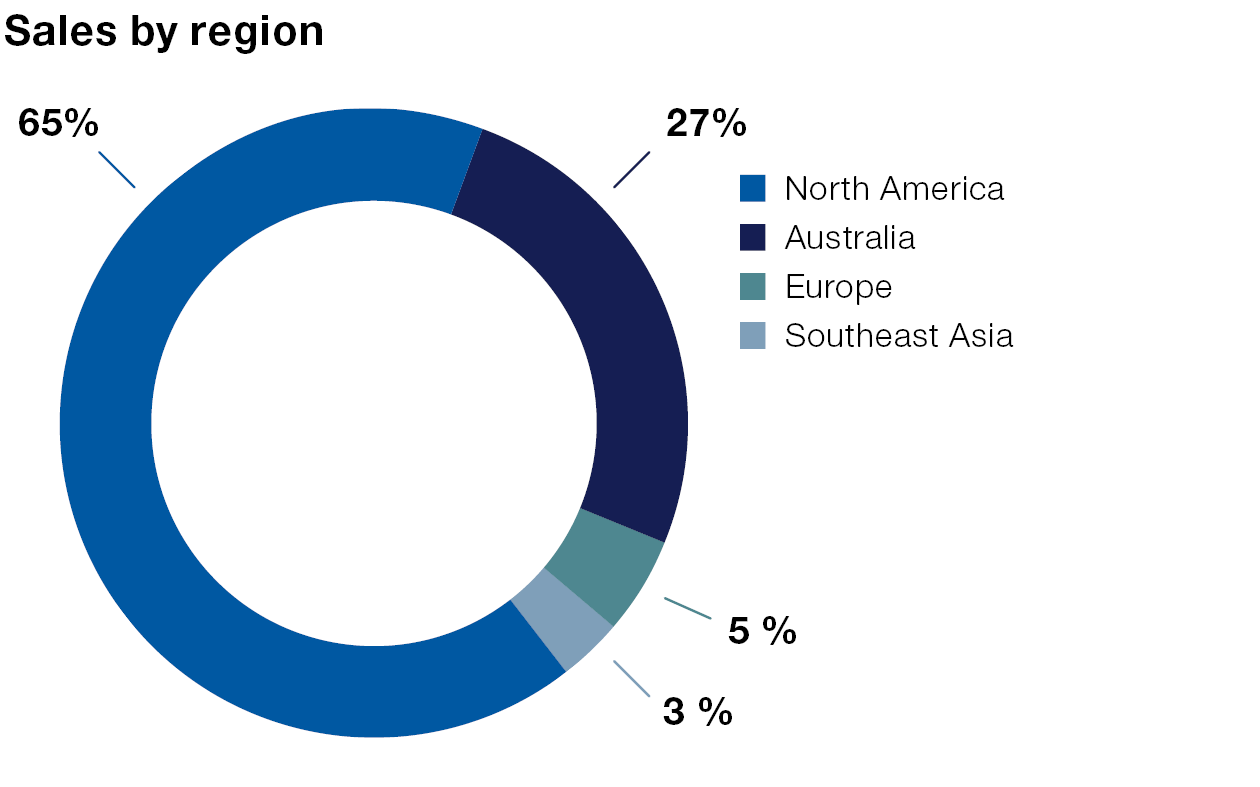

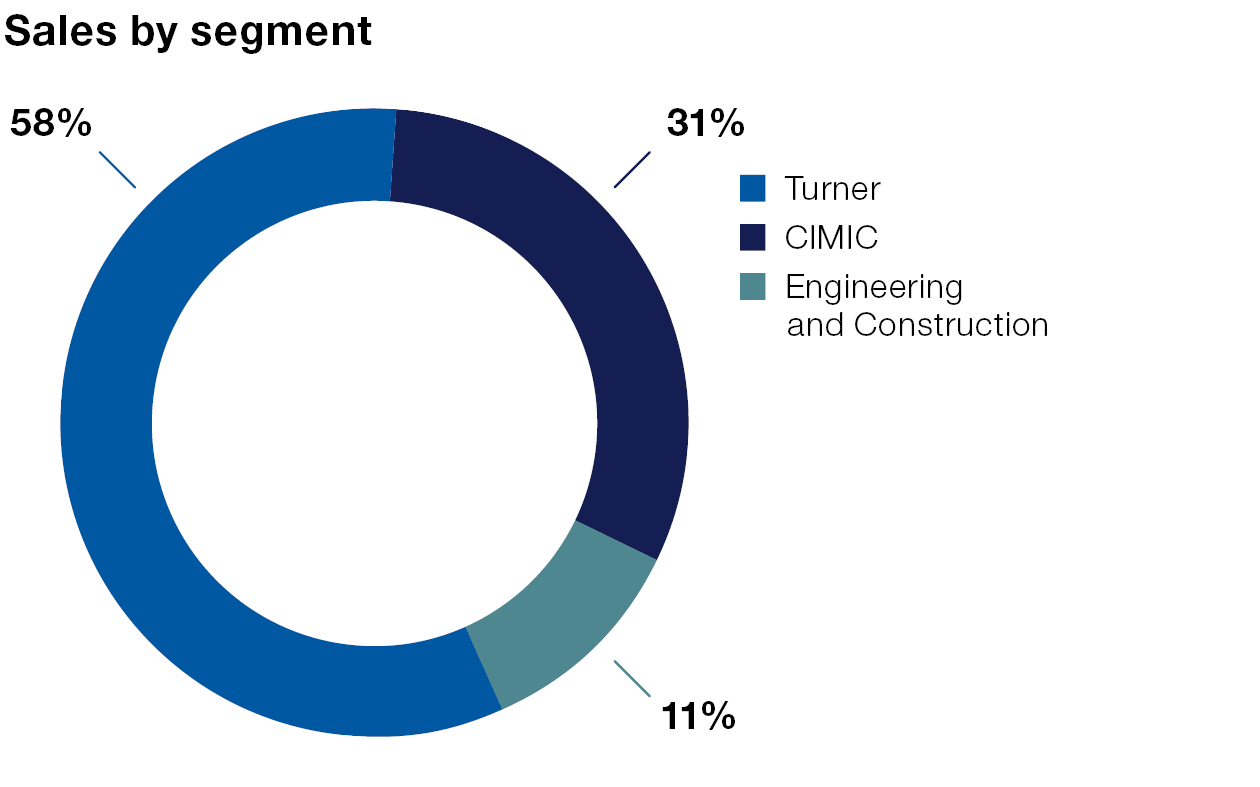

Diversified, global infrastructure exposure and market-leading subsidiaries

- HOCHTIEF is an engineering-led global infrastructure solutions provider with a history of over 150 years and leading positions in North America, Australia and Europe.

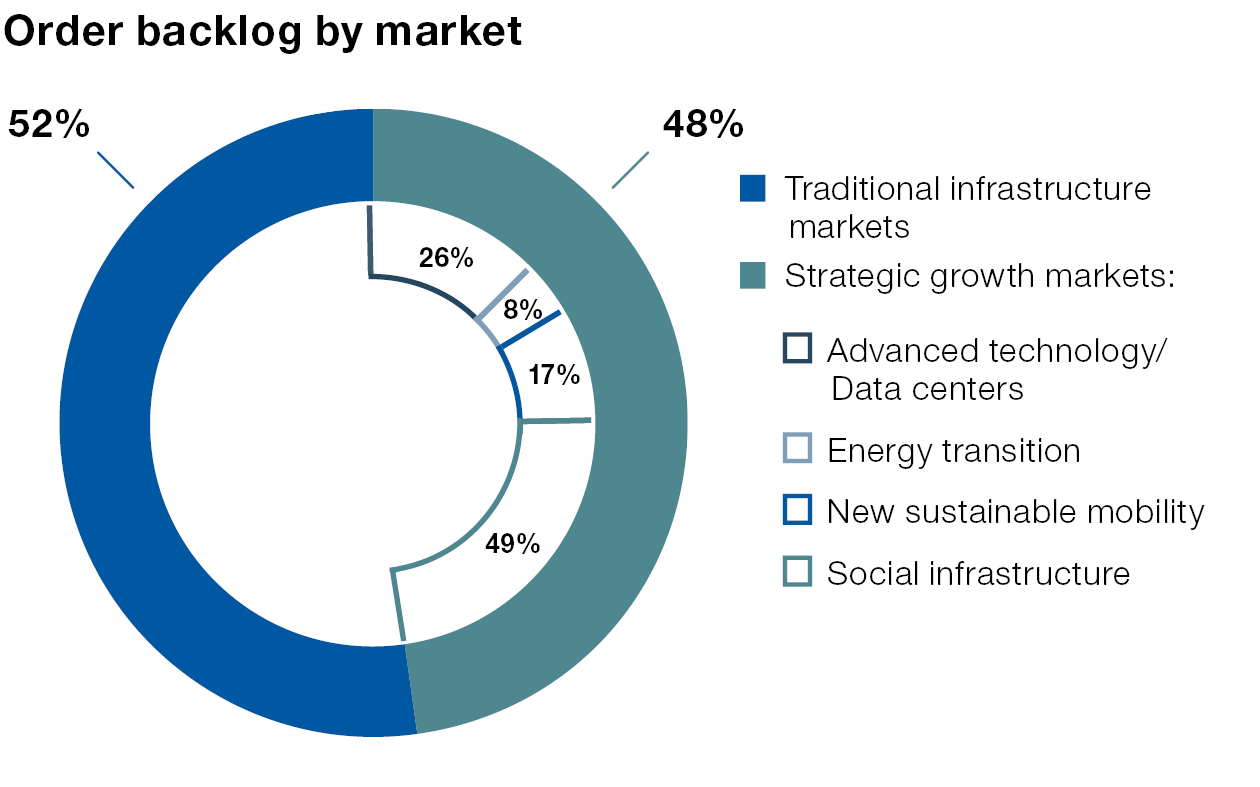

- Strong presence in the rapidly expanding strategic growth markets of data centers, energy transition and sustainable infrastructure.

- This unique combination results in a balanced business profile in terms of cash flow visibility, capital intensity and margins

-

Attractive shareholder remuneration

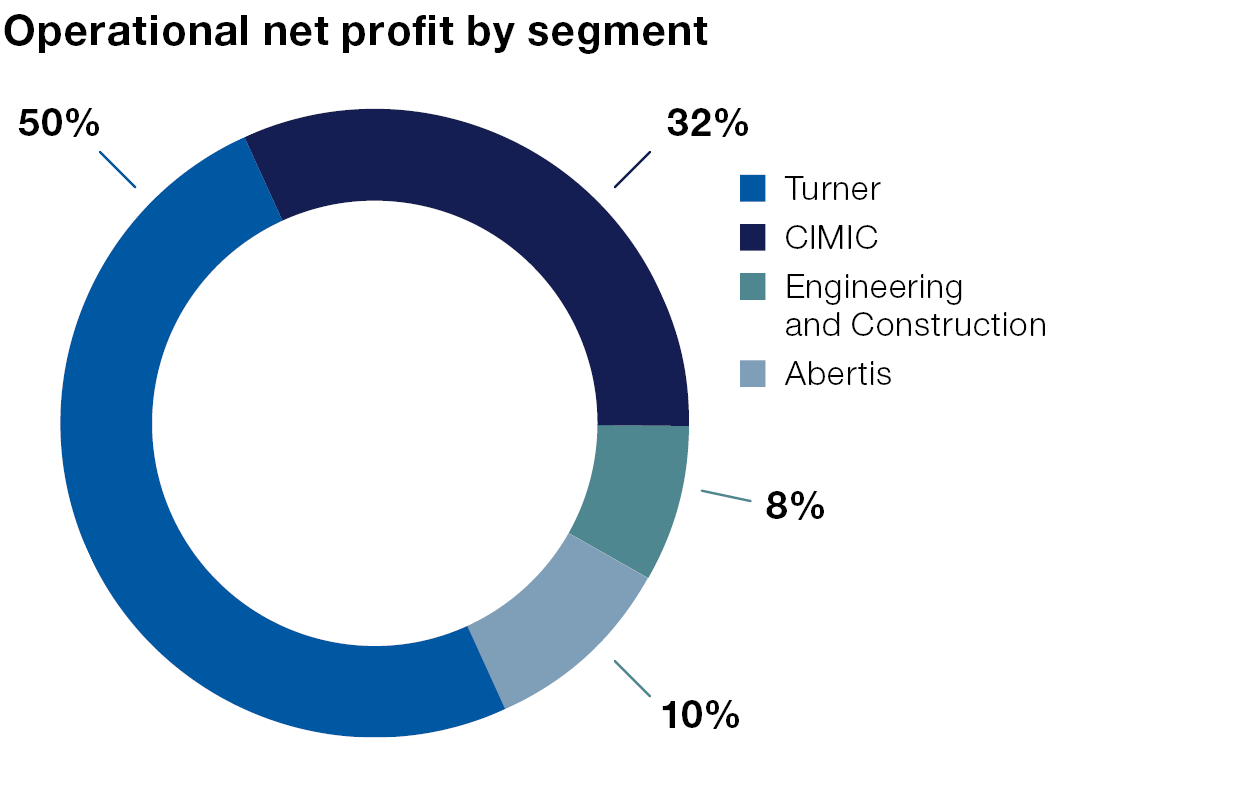

- Policy of paying out 65% of operational net profit as dividend

- Over the last 10 years, HOCHTIEF has distributed EUR 2.6 billion in dividends to its shareholders, equivalent to over EUR 38 per share.

- Track record of additional remuneration via share buyback programs

-

A beneficiary of global megatrends with an ambitious innovation strategy

- Global megatrends related to digitalization, decarbonization, demographics, urbanization and industrial relocation are driving strong investment growth in markets where HOCHTIEF is well positioned as a key player and can deliver attractive solutions for our private and public clients. Examples include:

- the roll-out of high-tech infrastructure including data centers, semiconductor and other advanced technology manufacturing facilities and state-of-the-art facilities

- the build-out of renewable energy- and related infrastructure needed for the energy transition in all our key markets

- the transformation of traditional transportation infrastructure to new mobility concepts

- the move towards industrial relocation of manufacturing capacity in North America and Europe

- healthcare and biopharma investments to meet the demands of aging populations

- the execution of resiliency projects that deliver new or refurbish existing infrastructure to cope with climate change effects such as extreme weather events and rising seal levels.

- Public budget constraints can limit actual investment in much needed transport and social infrastructure where HOCHTIEF can offer an integrated solution through public-private partnership

- Rapid advances in digitalization create application opportunities which we work on exploiting in cooperation with leading universities and IT companies.

- Global megatrends related to digitalization, decarbonization, demographics, urbanization and industrial relocation are driving strong investment growth in markets where HOCHTIEF is well positioned as a key player and can deliver attractive solutions for our private and public clients. Examples include:

-

Strong balance sheet and solid credit rating

- Strong balance sheet supports the operating businesses, capital allocation and investment opportunities

- Solid investment-grade rating by S&P underscores financial solidity and allows for bond financing on attractive terms

-

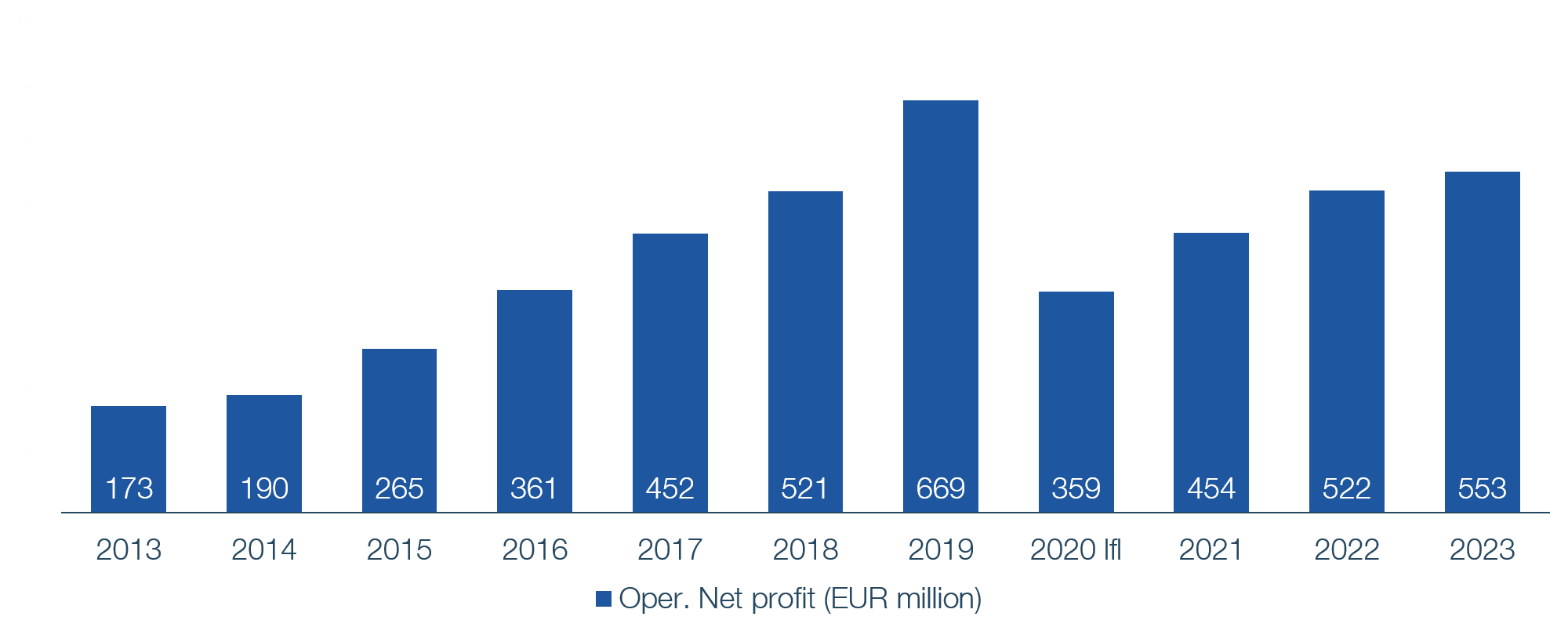

Strong track record of sustainable cash-backed operational profit growth

- Average operational net profit growth of 15% since 2020 with solid long-term outlook driven by an unprecedented and multi-year transformation of infrastructure sector investments driven by digitalization, demographics, decarbonization and deglobalization

- Key performance indicators used by HOCHTIEF group management teams strongly aligned with shareholders’ interests

- History of disciplined focus on capital allocation, including M&A and equity investments, to drive long-term value creation

- Risk management systems embedded across the group; flexible and streamlined operational set-up

Operational net profit development (EUR million)

-

Values-led corporate culture and consistently positive ESG recognition

- Five guiding principles that apply to all employees: integrity, accountability, innovation, delivery and sustainability – all underpinned by the precondition of safety

- Dedicated sustainability strategy balancing economic objectives with ecological and social responsibilities

- Commitment to support the Paris Climate Agreement and be climate-neutral by 2045

- Consistently positive results in leading ESG surveys/indices.

- The Group has been included in the renowned Dow Jones Sustainability Indices of S&P Global for the 19th year in a row.

- Additional recognition: MSCI (AAA Rating), Carbon Disclosure Project (CDP; “A-“ Rating), Sustainalytics (“ESG industry top rated company” award 2024), FTSE4Good ESG Rating (Score 3.4) and EcoVadis (gold medal)

This might also be of interest to you

HOCHTIEF shares overviewOur strategy objective: Generating sustainable value for all stakeholders

Since 1873: The history of HOCHTIEF